Volusion Payments Powered by Stripe: What to Expect When You Apply

Volusion Payments Powered by Stripe, our integrated credit card processing solution, is Volusion’s preferred payment gateway provider that is designed to fully complement your Volusion store.

Read more about our Terms & Conditions

Learn More About Volusion Payments Powered By Stripe!

Watch our video to learn about Volusion Payments, discover its benefits, and see how to easily integrate it into your store!

What To Expect?

We are eager for your business to add Volusion Payments Powered by Stripe to your ecommerce site.

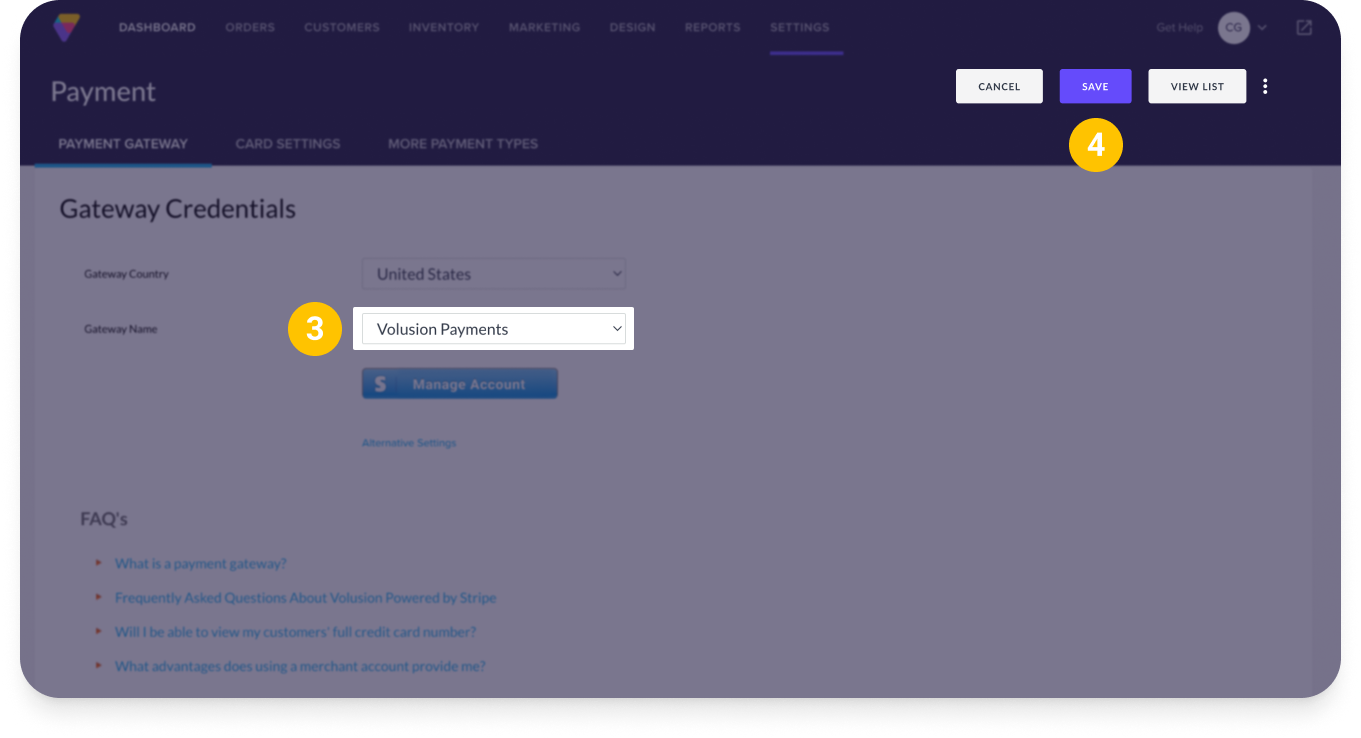

STEP 1: Apply Now

- Log into your Volusion Dashboard

- Navigate to Settings > Payments

- Click the apply now button on the right

- Complete the application form

NOTICE:

- Your store will remain active on your previously configured gateway and you will be able to continue to process payments

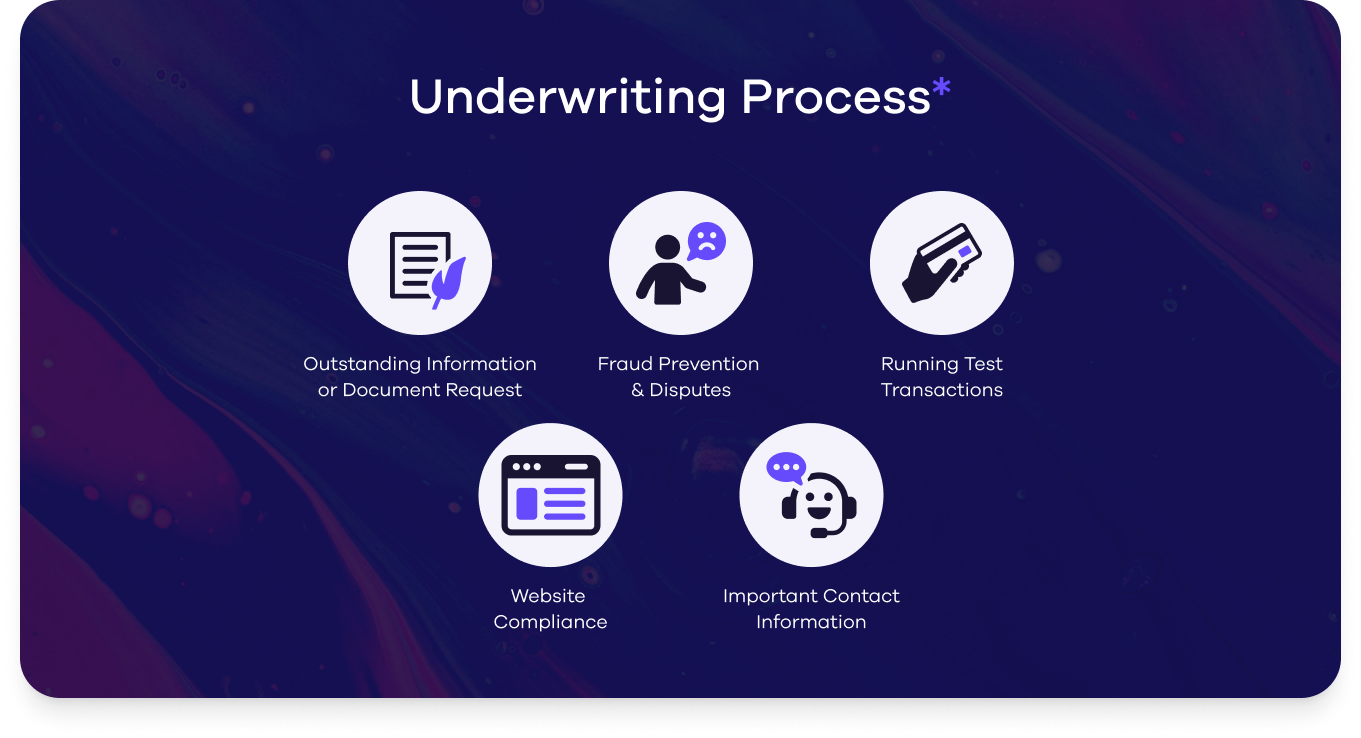

STEP 2: Underwriting Process

Once you submit your application, the Underwriting process* will begin.

The time it takes to complete this process is based on you providing the required documentation and resolving any concerns that may arise during the Underwriting process.

Our Payments Team and your Client Growth Specialist will communicate with you throughout this process. They will provide you with detailed instructions and resources regarding important information such as:

- Outstanding Information or Document Requests

- Fraud Prevention & Disputes

- Running Test Transactions

- Website Compliance

- Important Contact Information

STEP 3: Approval

After the Underwriting Process is complete you will receive an email from credit@volusion.com when approved.

Once approved you will need to enable Volusion Payments on your store.

Why Choose Volusion Payments?

Take advantage of a centralized payments solution that gives you more time to focus on your customers.

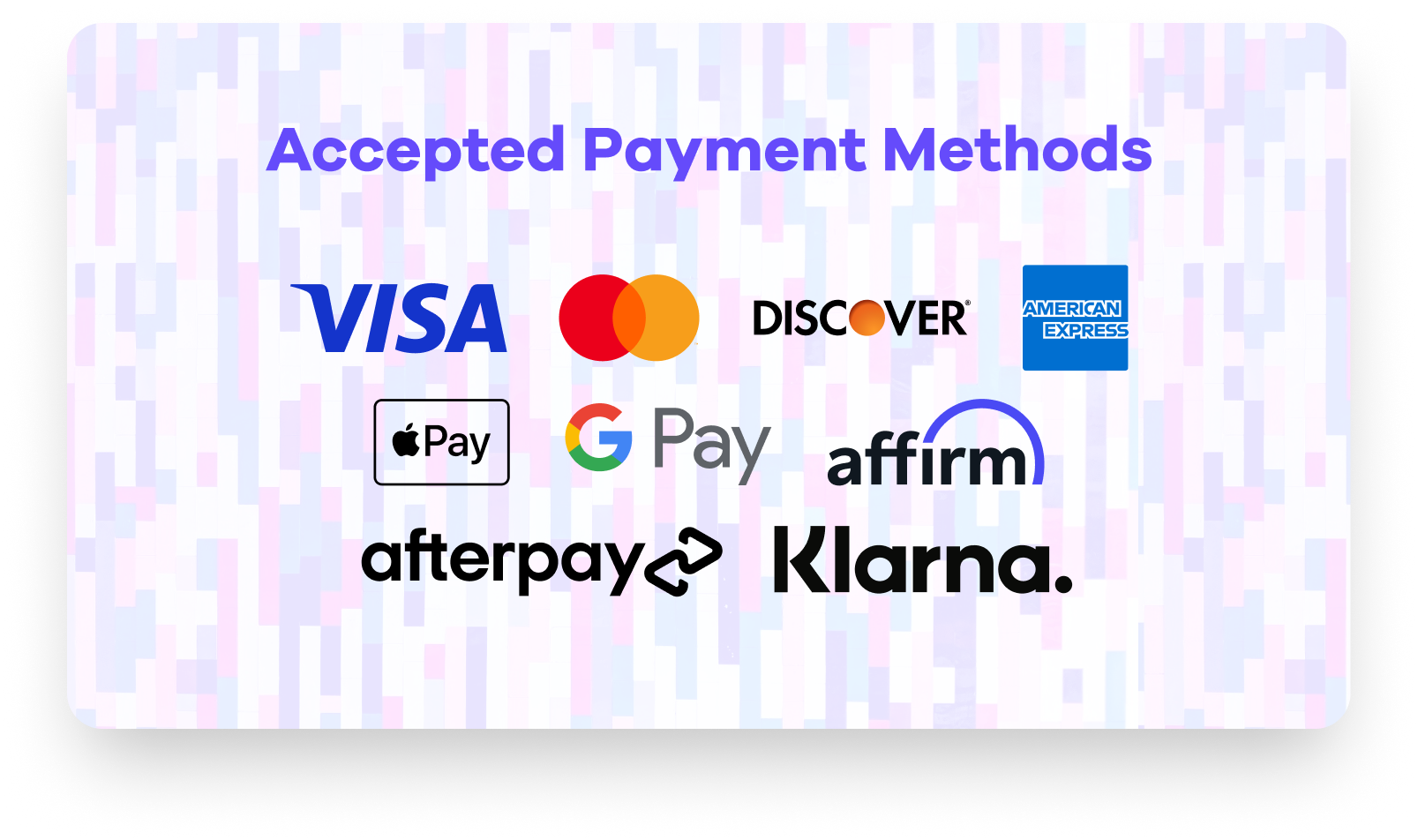

- Buy Now, Pay Later: Boost sales, increase order value, and reach new customers by offering Affirm, Afterpay/Clearpay, and Klarna.*

- Wallet Payments: Customers can use wallets to pay online with a saved card or a digital wallet balance for Apple Pay, Google Pay, and more.

- Link: Stripe’s native payment method autofills your customers’ payment and shipping details to deliver an easy and seamless checkout experience.

- Radar: A modern solution to detect and block fraud using machine learning that is built in automatically for every Stripe account.

- NO Setup Fees

- NO Monthly Processing Min/Max

- NO Gateway Maintenance Fees

- NO Hidden Fees

*A 6% flat fee applies to all Buy Now, Pay Later transactions.

Is Volusion Payments a gateway?

Volusion Payments Powered by Stripe is a complete solution that combines the functionality of a merchant account and a gateway in one, which means you can accept payments and deposit funds into a bank account without extra steps or additional tools to maintain.

Why should I use Volusion Payments instead of other gateways?

Volusion merchants who choose to use an alternative supported payment gateway are subject to Gateway Maintenance Fees per transaction of 1.25% for Personal Plans, 0.65% for Professional Plans, 0.35% for Business Plans, and custom percentages for Prime Plans.

Who is Volusion Payments for? Who cannot use Volusion Payments?

- Volusion Payments is currently available to merchants living and operating out of the United States that aren’t selling prohibited products/services.

- You must have Premium Checkout enabled to be eligible for Volusion Payments. Follow these step-by-step instructions in our Help Center to enable this enhanced checkout process.

I submitted my application, now what?

A Client Growth Specialist will contact you to obtain and confirm your business model, billing practices, product usage, processing history, etc so that our credit underwriters can assess your application. Be sure to provide all information and/or documents so that we can underwrite quickly. Typical underwriting turnaround time is 24 hours.

How long does it take to get paid?

Your first payout is typically available 7 days after you add your bank account and take your first successful payment on Stripe. This waiting period can be up to 30 days for businesses in certain industries. This delay allows Volusion to mitigate some of the risks inherent in providing credit services. This initial payout timing requirement cannot be waived. Any changes made to your payout timing or payout method during this time will take effect after this initial delay.

For the 2nd payout and onward, your standard payout timing will be on a 2-day rolling basis.

If you have been actively processing during the underwriting process, once approved, your initial payout will be 2-3 business days from the time of approval and then all payments afterward would be on the 2-day rolling basis.

What happens if I don’t get approved?

Read more about our Terms & Conditions

Helpful Resources

Discover articles and resources at the Volusion Helpcenter for in-depth insights into Volusion Payments.

Volusion Payments

Contact Us

Volusion's Payment Processing Team

Can Help With:

- Account Maintenance

- Deposit Questions

- Fee Questions

- Payment Gateway Help

- Dispute Inquiries

Contact:

- vmc@volusion.com

- (800) 646-3517: select option 2, enter your pin, then select option 3

Volusion's Risk Team

Can Help With:

- Reviewing large orders to determine if fraudulent

- Providing steps to prevent card testing

- Help with emails from their team requesting invoices or shipping documentation

Contact:

*What Merchant Underwriting Means:

Volusion assumes risk when providing payment services. To mitigate this risk, we complete careful analyses and evaluate applicants while meeting the standards set forth by the Federal Deposit Insurance Corporation, our Terms of Service, card brand rules, and all laws and regulations. Volusion will conduct our review of your application by completing a business credit check and a soft personal credit check that will not affect your credit score. We may also ask for documents such as Articles of Incorporation, Operating Agreement, Employer Identification Number/Social Security Number Verification Document, Address Verification Document, Business Bank Statements, Financial Statements, Tax Returns, and other documents as needed.

6504 Bridge Point Pkwy Ste 125 Austin TX 78730 United States

Volusion is a registered ISO of Wells Fargo Bank, N.A., Concord, CA | Privacy Policy | Terms of Service